The Ultimate Guide To Clark Wealth Partners

Things about Clark Wealth Partners

Table of ContentsThe Ultimate Guide To Clark Wealth PartnersWhat Does Clark Wealth Partners Do?The Clark Wealth Partners StatementsFascination About Clark Wealth PartnersIndicators on Clark Wealth Partners You Need To KnowClark Wealth Partners Things To Know Before You Get ThisNot known Incorrect Statements About Clark Wealth Partners The 8-Second Trick For Clark Wealth Partners

There's no single route to becoming one, with some people beginning in financial or insurance policy, while others begin in accounting. 1Most economic coordinators start with a bachelor's degree in finance, business economics, accounting, service, or a relevant subject. A four-year degree offers a solid structure for jobs in investments, budgeting, and customer solutions.Several hopeful organizers invest one to 3 years building these sensible abilities. 3Although not legally required, the CFP credential is extensively considered the market gold criterion. The test is provided three times yearly and covers areas such as tax, retired life, and estate preparation. 4To earn the CFP classification, you must complete either 6,000 hours of specialist experience or 4,000 hours via the Apprenticeship Pathway.

Common instances include the FINRA Collection 7 and Series 65 exams for safety and securities, or a state-issued insurance policy certificate for offering life or medical insurance. While qualifications might not be lawfully required for all intending duties, companies and customers frequently see them as a criteria of expertise. We consider optional qualifications in the following area.

Our Clark Wealth Partners Ideas

The majority of monetary coordinators have 1-3 years of experience and experience with economic items, compliance criteria, and straight client communication. A strong instructional background is vital, however experience demonstrates the capability to use theory in real-world setups. Some programs combine both, enabling you to finish coursework while gaining supervised hours with teaching fellowships and practicums.

Very early years can bring lengthy hours, stress to develop a customer base, and the need to consistently show your experience. Financial planners enjoy the chance to function carefully with clients, guide essential life choices, and typically achieve adaptability in routines or self-employment.

Excitement About Clark Wealth Partners

The annual median income for these professionals was $161,700 as of 2024. To end up being an economic planner, you commonly need a bachelor's level in money, business economics, business, or a relevant subject and several years of appropriate experience. Licenses might be needed to offer protections or insurance coverage, while accreditations like the CFP boost credibility and profession possibilities.

Optional certifications, such as the CFP, generally call for added coursework and screening, which can expand the timeline by a couple of years. According to the Bureau of Labor Statistics, individual economic advisors gain a mean yearly yearly salary of $102,140, with leading earners making over $239,000.

What Does Clark Wealth Partners Mean?

To load their footwear, the country will need even more than 100,000 new economic consultants to enter the sector.

Aiding people achieve their monetary objectives is a financial expert's key function. They are likewise a small company owner, and a portion of their time is committed to handling their branch office. As the leader of their method, Edward Jones monetary consultants require the leadership abilities to hire and take care of staff, as well as business acumen to create and perform a business technique.

The Clark Wealth Partners Ideas

Edward Jones economic experts are encouraged to go after added training to broaden their knowledge and abilities. It's likewise an excellent idea for monetary consultants to participate in sector seminars.

That indicates every Edward Jones associate is free to concentrate 100% on the customer's ideal passions. Our collaboration framework is joint, not competitive. Edward Jones economic experts appreciate the assistance and camaraderie of other financial advisors in their region. Our economic experts are urged to use and receive assistance from their peers.

What Does Clark Wealth Partners Mean?

2024 Ton Of Money 100 Best Business to Job For, released April 2024, research study by Great Places to Work, data since August 2023. Settlement attended to making use of, not obtaining, the rating.

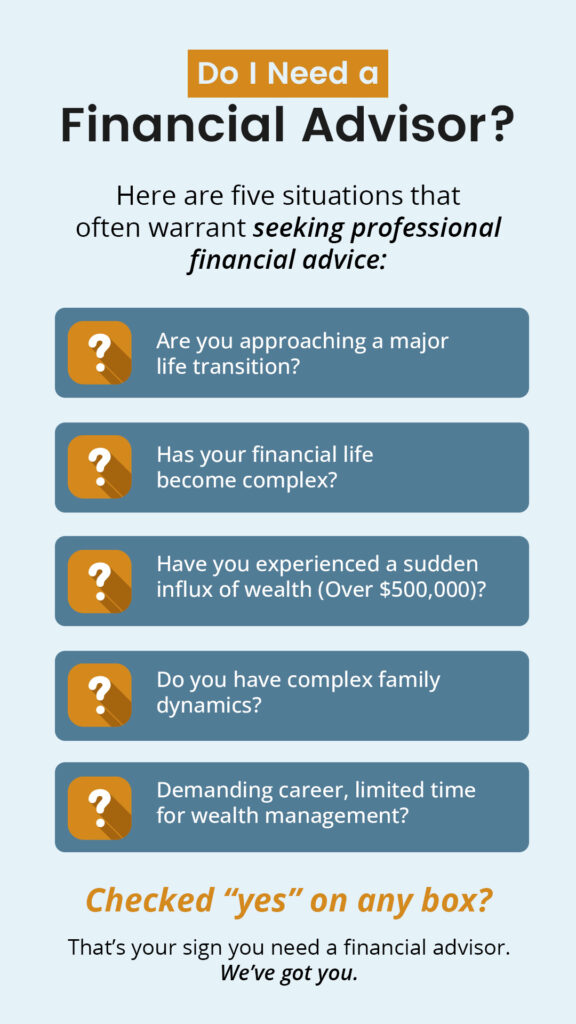

When you need assistance in your economic life, there are numerous professionals you might seek advice from. Fiduciaries and financial consultants are two of them (financial advisor st. louis). A fiduciary is an expert who manages cash or property for other parties and has a lawful task to act only in their customer's benefits

Financial advisors should schedule time each week to meet brand-new individuals and capture up with the people in their round. Edward Jones monetary advisors are privileged the home workplace does the heavy training for them.

Clark Wealth Partners Fundamentals Explained

Edward Jones financial experts are encouraged to pursue extra training to expand their understanding and abilities. It's additionally an excellent idea for financial advisors to go to market meetings.

Edward Jones economic consultants enjoy the assistance and friendship of dig this other financial consultants in their region. Our financial experts are urged to offer and receive assistance from their peers.

2024 Fortune 100 Best Business to Work For, released April 2024, research by Great Places to Function, data since August 2023. Payment offered utilizing, not getting, the score.

The smart Trick of Clark Wealth Partners That Nobody is Talking About

When you require assistance in your economic life, there are several professionals you might look for guidance from. Fiduciaries and monetary consultants are 2 of them. A fiduciary is a professional who handles money or building for other parties and has a legal task to act just in their customer's benefits.